Looking to grow your savings faster with minimal risk? As we step into October 2024, several banks are offering competitive high-interest savings accounts designed to help you earn more on your money. These accounts offer much higher rates than traditional savings accounts, allowing you to maximize your financial potential with ease.

![]()

What Is a High-Interest Savings Account?

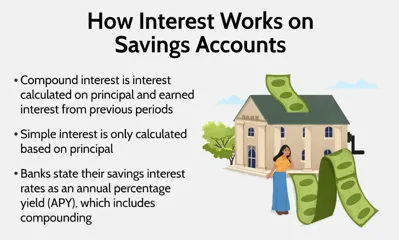

A high-interest savings account functions similarly to a regular savings account but offers a much higher annual percentage yield (APY). This means your money grows faster without the complexity of riskier investments. By understanding how these accounts work and the specific benefits they offer, you can choose one that aligns with your savings goals.

Top High-Yield Savings Accounts for October 2024:

Here are some of the most competitive savings accounts available this month:

- SoFi High-Yield Savings Account

- APY: 4.30%

SoFi offers one of the best high-yield savings accounts, particularly for those who set up direct deposits. With no minimum balance requirements, it’s accessible to everyone. Plus, SoFi gives users access to no-fee ATMs, which adds convenience.

- APY: 4.30%

- CIT Bank Platinum Savings

- APY: 4.70%

CIT Bank offers a competitive 4.70% APY for balances over a specific threshold. Keeping your balance above this limit ensures you get the maximum benefit from this account. For balances below the threshold, the APY drops to 0.25%, so it’s essential to maintain the required minimum.

- APY: 4.70%

- Western Alliance High-Yield Savings (via Raisin)

- APY: Up to 4.75%

Western Alliance, through its partnership with Raisin, offers a high-yield savings account with one of the best rates in the market. It provides users with flexibility and high returns, perfect for those looking to maximize their savings with minimal effort.

- APY: Up to 4.75%

- Barclays Tiered Savings

- APY: Up to 4.80%

Barclays offers a tiered savings system, where higher balances unlock top APY rates. With no fees and around-the-clock online access, this account is a great option for individuals who can maintain larger balances to qualify for the higher tiers.

- APY: Up to 4.80%

Benefits of High-Interest Savings Accounts

Choosing a high-interest savings account can offer more than just higher returns. Here’s why they stand out:

- Active Growth: These accounts allow your savings to grow actively with minimal risk. With higher rates, your money works for you without any effort.

- Compound Interest: The magic of compound interest means your money grows exponentially, earning interest on both the principal and the accumulated interest over time.

- Flexibility and Access: Unlike many investment options, high-interest savings accounts offer easy access to your funds without fees for withdrawals, making them highly flexible for short-term and emergency needs.

- Low Risk: High-interest savings accounts are typically insured by FDIC or equivalent agencies, ensuring your money is safe while earning consistent growth.

How to Maximize Your Savings

To make the most of high-interest savings accounts:

- Stay Informed: Continuously compare offers and be ready to switch accounts when better rates become available.

- Set Up Direct Deposits: Some accounts offer higher APYs when you have regular direct deposits, so this is a great way to unlock the best benefits.

- Monitor Fees and Requirements: Be mindful of balance requirements to avoid missing out on the highest interest rates or incurring unnecessary fees.

Conclusion

High-interest savings accounts are an excellent way to boost your savings with minimal effort and risk. Whether you prefer the ease of SoFi, the high returns of CIT Bank, or the flexibility of Barclays, October 2024 is the perfect time to capitalize on the high rates available. With a little research and financial planning, you can watch your money grow faster than ever while keeping it secure.